Some Known Incorrect Statements About Offshore Trust Services

Wiki Article

The Definitive Guide to Offshore Trust Services

Table of ContentsHow Offshore Trust Services can Save You Time, Stress, and Money.Offshore Trust Services Things To Know Before You BuyNot known Incorrect Statements About Offshore Trust Services The smart Trick of Offshore Trust Services That Nobody is Talking AboutThe Ultimate Guide To Offshore Trust ServicesThe 4-Minute Rule for Offshore Trust ServicesOffshore Trust Services for Beginners9 Simple Techniques For Offshore Trust Services

Personal creditors, also bigger private corporations, are a lot more amendable to resolve collections versus debtors with difficult and also efficient asset security strategies. There is no possession security strategy that can prevent a highly inspired lender with limitless money as well as patience, but a properly designed overseas trust fund commonly gives the debtor a positive settlement.Trustee firms charge annual fees in the variety of $1,000 to $5,000 annually plus hourly prices for added solutions. Offshore trusts are except everyone. For many people staying in Florida, a domestic property security plan will be as reliable for a lot less money. However for some people dealing with difficult lender problems, the overseas count on is the ideal alternative to safeguard a considerable quantity of assets.

Borrowers may have a lot more success with an overseas count on plan in state court than in a personal bankruptcy court. Judgment creditors in state court litigation might be frightened by overseas property defense trust funds as well as may not look for collection of properties in the hands of an overseas trustee. State courts lack jurisdiction over offshore trustees, which means that state courts have limited remedies to purchase conformity with court orders.

Not known Incorrect Statements About Offshore Trust Services

debtor documents insolvency. An insolvency debtor should surrender all their properties and legal rate of interests in home any place held to the bankruptcy trustee. Personal bankruptcy courts have worldwide jurisdiction as well as are not discouraged by foreign nations' rejection to acknowledge basic civil court orders from the united state. A united state bankruptcy court might oblige the insolvency debtor to do whatever is called for to commit the bankruptcy trustee all the borrower's properties throughout the globe, including the borrower's advantageous passion in an offshore trust.Offshore property protection trust funds are less efficient versus internal revenue service collection, criminal restitution judgments, and family members sustain responsibilities. 4. Also if a united state court does not have jurisdiction over overseas depend on properties, the U.S. court still has personal territory over the trustmaker. The courts may attempt to force a trustmaker to liquify a trust or bring back depend on properties.

The trustmaker must want to quit legal civil liberties and control over their trust properties for an overseas count on to effectively protect these assets from U.S. judgments. 6. Selection of a professional and reliable trustee who will defend an offshore count on is more crucial than selecting an overseas depend on jurisdiction.

Indicators on Offshore Trust Services You Should Know

Each of these nations has count on statutes that are desirable for overseas possession protection. There are subtle legal distinctions among overseas trust territories' laws, however they have much more attributes in common.

Official statistics on depends on are hard to come by as in most offshore territories (and also in the majority of onshore territories), counts on are not called for to be registered, nonetheless, it is thought that the most common use of overseas counts on is as part of the tax obligation as well as financial planning of affluent individuals as well as their households.

The Facts About Offshore Trust Services Uncovered

In an Unalterable Offshore Depend on might not be transformed or sold off by the settlor. A makes it possible for the trustee to choose the circulation of earnings for various classes of recipients. In a Set depend on, the distribution of earnings to the beneficiaries is dealt with and also can not be transformed by trustee.Confidentiality and also privacy: In spite of the truth that an offshore trust fund is officially signed up in the government, the parties of the trust fund, assets, and also the conditions of the trust fund are not taped in the register. Tax-exempt condition: Assets that are transferred to an overseas trust (in a tax-exempt offshore area) are not tired either when moved to the count on, or when moved or rearranged to the beneficiaries.

8 Easy Facts About Offshore Trust Services Described

This has likewise been done in a number of United state states., then the trustees need to take a positive duty in the events on the business., however continues to be component of trust fund law in numerous usual legislation territories.Paradoxically, these specialised forms of trusts seem to rarely be used in relationship to their initial desired uses.

Certain jurisdictions (significantly the Chef Islands, but the Bahamas Has a species of property protection count on) have actually offered unique trusts which are styled as possession defense trusts. While all trusts have an property defense aspect, some jurisdictions have passed laws trying to make life hard for creditors to press claims against the trust fund (for example, by providing for especially short restriction periods). An offshore count on is a device used for asset protection as well as estate planning that works by moving possessions right into the control of a lawful entity based in another nation. Offshore counts on are irrevocable, so count on owners can not reclaim possession of transferred assets. They are also made complex and also pricey. For people with greater responsibility concerns, offshore trust funds can offer defense and also greater personal privacy as well as some tax benefits.

Our Offshore Trust Services Diaries

Being offshore adds a layer of defense and personal privacy as well as the capability to manage taxes. Because the counts on are not situated in the United States, they do not have to follow United state laws or the judgments of U.S. courts. This makes it much more challenging for financial institutions and also plaintiffs to go after cases article against possessions held in offshore trusts.It can be difficult for 3rd parties to determine the possessions and owners of overseas trusts, that makes them help to personal privacy. In order to establish an overseas depend on, the very first step is to pick a foreign country in which to locate the counts on. Some preferred areas consist of Belize, the Cook Islands, Nevis as well as Luxembourg.

Getting My Offshore Trust Services To Work

Transfer the properties that are to be protected right into the depend on - offshore trust services. Offshore depends on can be helpful for estate planning and also possession security but they have limitations.Incomes by possessions positioned in an offshore count on are free of United state taxes. United state proprietors of offshore depends on additionally have to submit records with the Internal Earnings Service.

Not known Details About Offshore Trust Services

Corruption can be a concern in some countries. Additionally, it is necessary to choose a country that is not likely to experience political unrest, regime adjustment, economic upheaval or quick modifications to tax plans that might make an offshore trust fund much less helpful. Lastly, asset defense counts on typically have actually to be established before they are needed - offshore trust services.They additionally do not completely visit this page safeguard against all insurance claims and also may subject proprietors to risks of corruption and also political instability in the host countries. Nonetheless, offshore depends on are helpful estate preparation as well as possession security devices. Recognizing the correct time to utilize a particular depend on, and which trust fund would give the most profit, can be complicated.

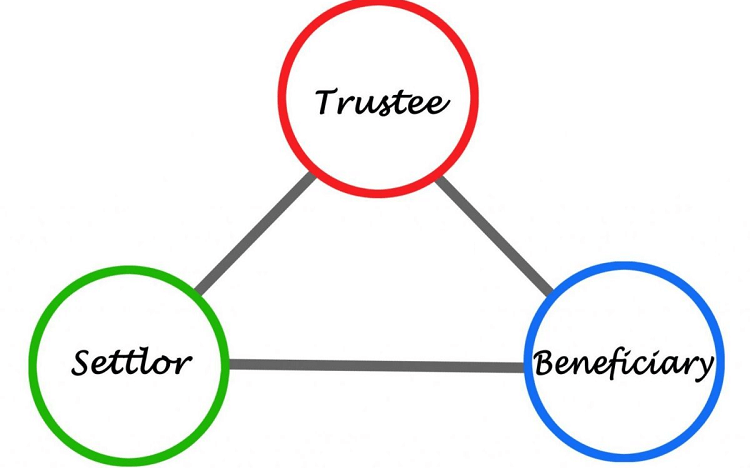

Think about using our resource on the trust funds you can utilize to profit your estate planning., i, Stock. com/scyther5, i, Stock. com/Andrii Dodonov. An Offshore Count on is a traditional Trust shaped under the legislations of nil (or reduced) tax Worldwide Offshore Financial. A Count on is a legal strategy (similar to an agreement) whereby one person (called the "Trustee") in accordance with a succeeding individual (called the "Settlor") authorizations to recognize as well as hold the property to aid look at this now various individuals (called the "Recipients").

Report this wiki page